Turn Accounting Data into Leadership Decisions in Just 7 Days

Automated.

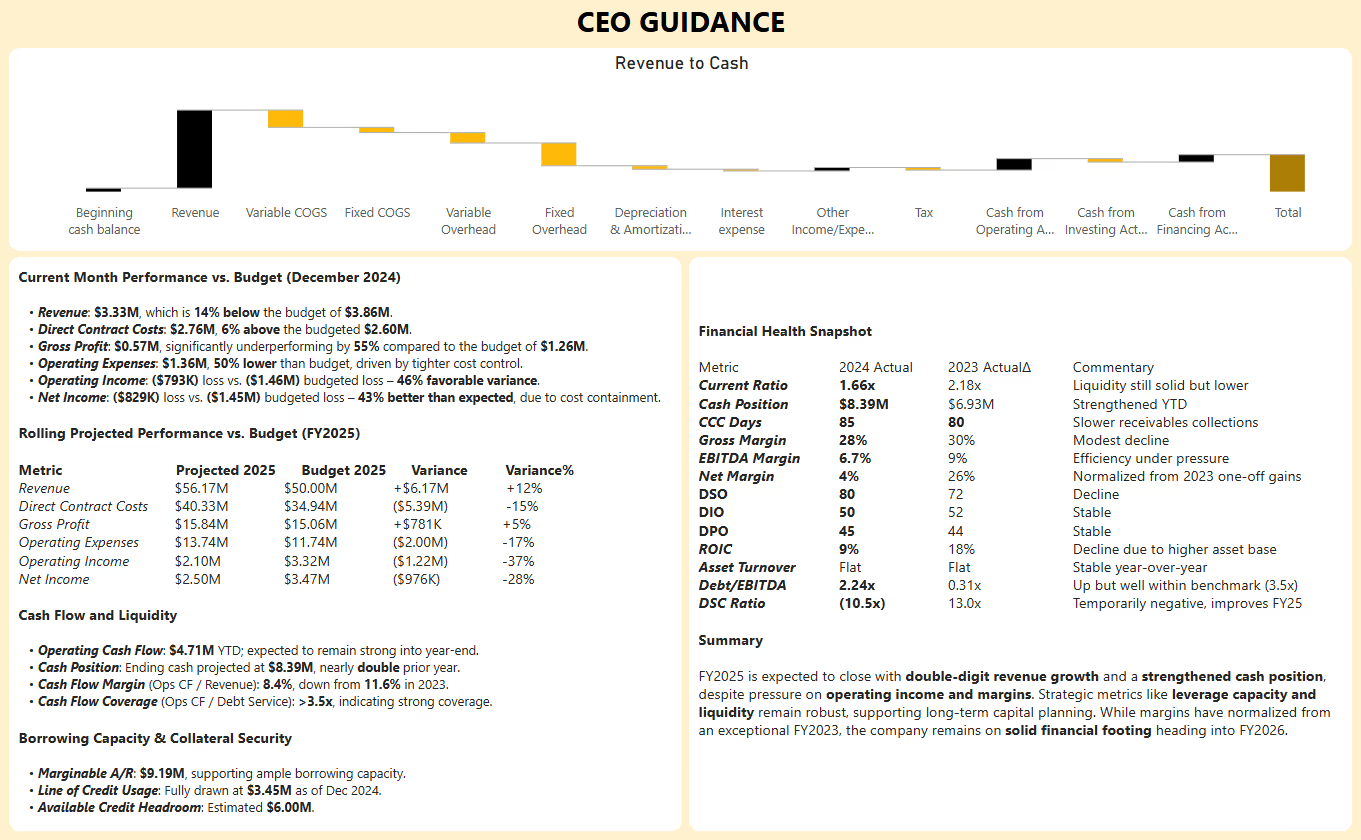

Your Strategic Finance Control Center

Financiario is the strategic finance system that turns your accounting reports into decision-ready intelligence — so you manage cash, capital, and growth with confidence

not guesswork.

Your FP&A tools give you numbers.

Financiario gives you Foresight.

You don’t need another dashboard. You need a system that shows what’s coming

and what to do about it.

No CFO? No problem. Financiario acts as your on-demand strategic finance partner—delivering real-time reports, forecasts, and capital planning tools that help you make high-stakes decisions without relying on guesswork or delayed analysis.

Already have a CFO? Financiario amplifies their impact—automating the heavy lifting, aligning forecasts to strategy, and freeing them to focus on what matters: driving capital efficiency, performance, and long-term value.

Financial intelligence your board, bank, and executive team can rely on

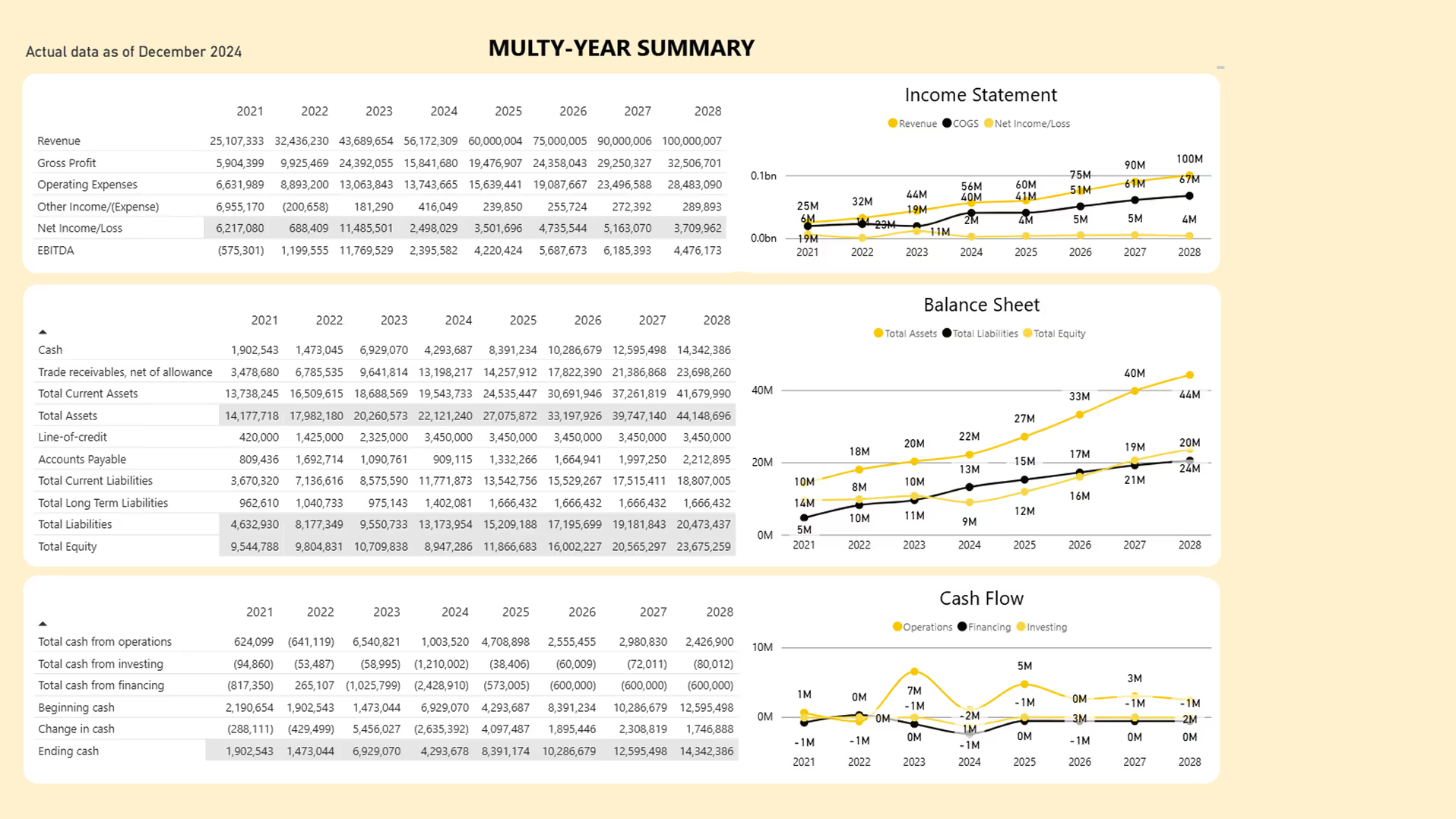

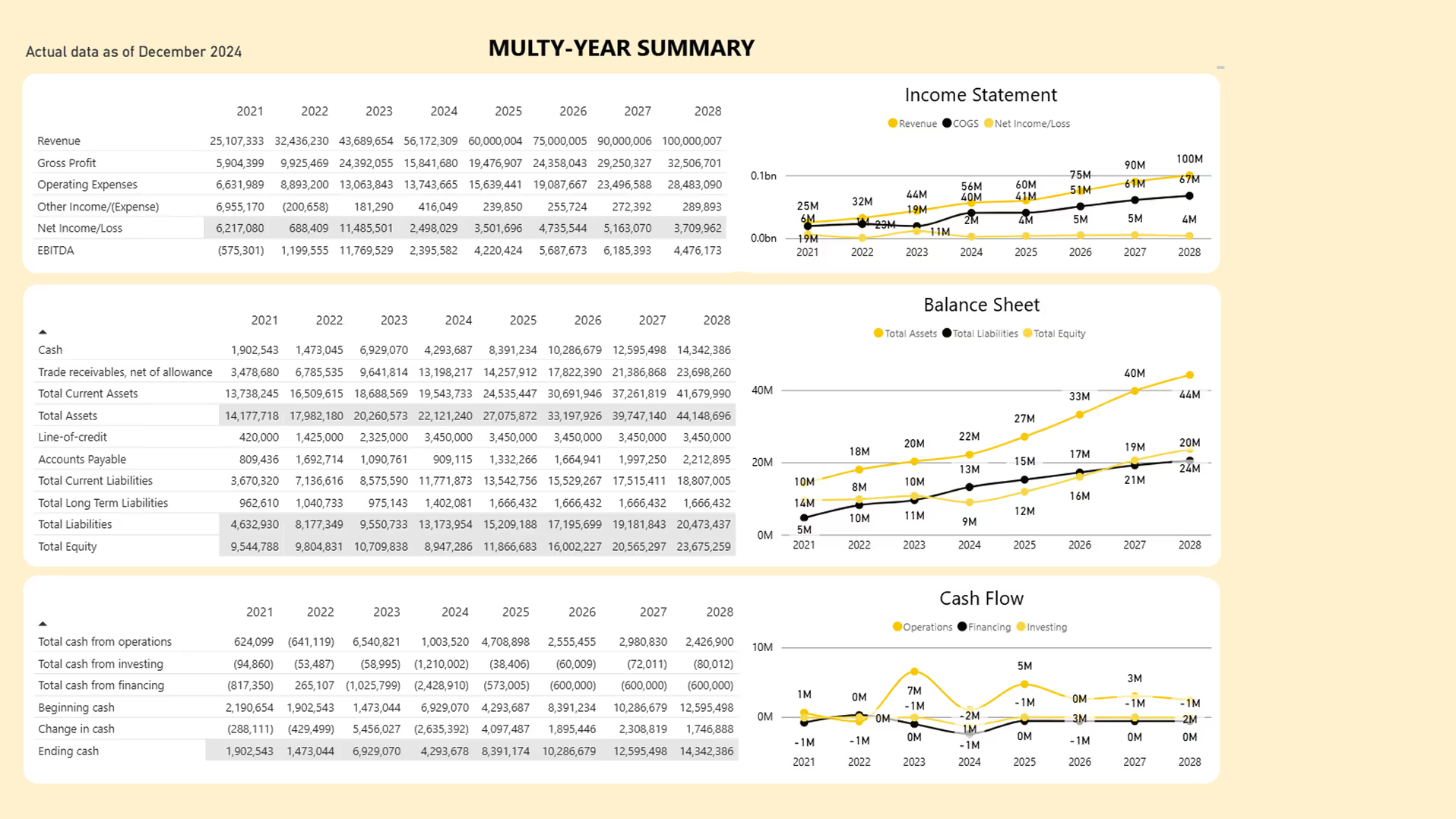

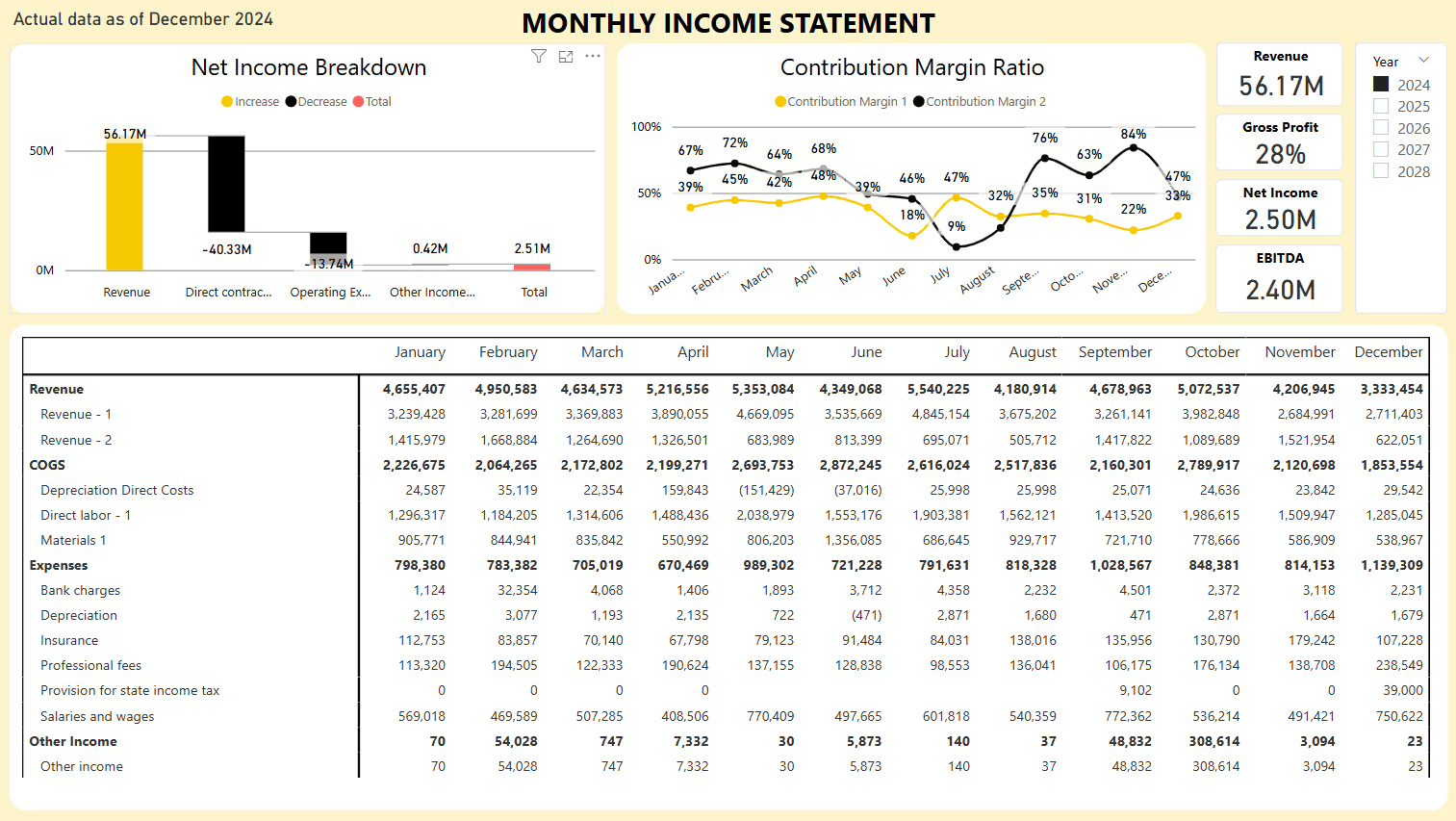

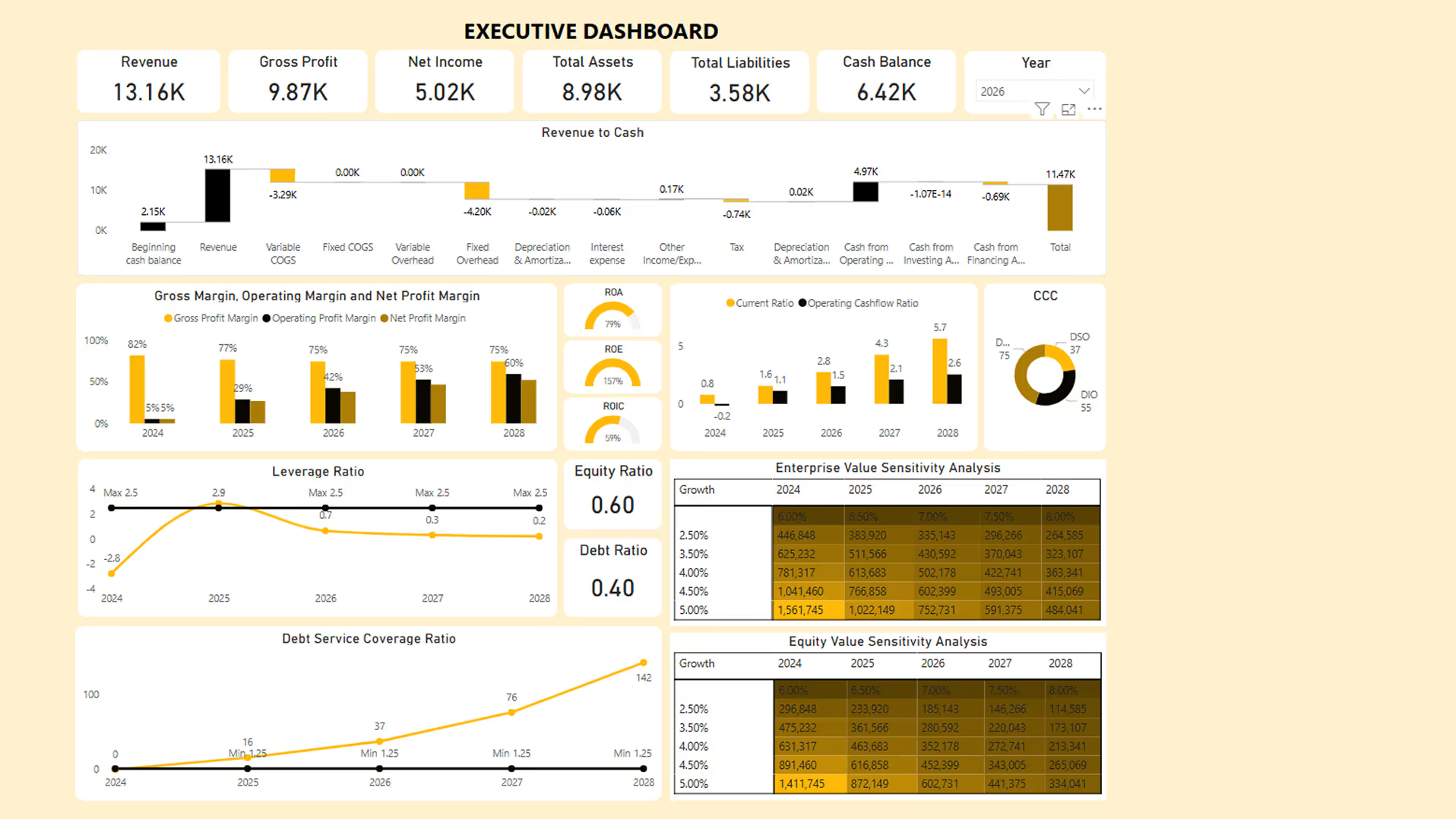

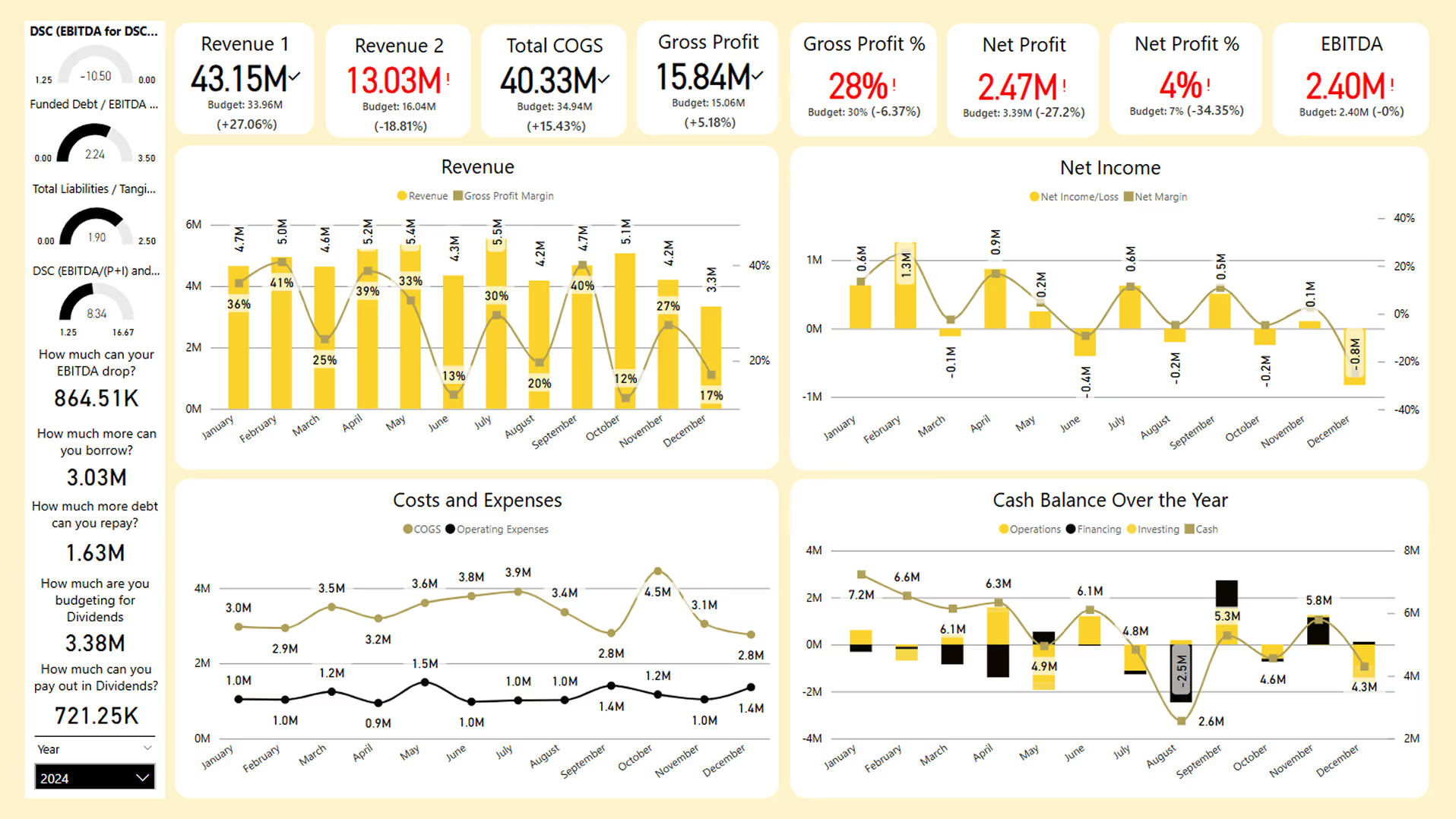

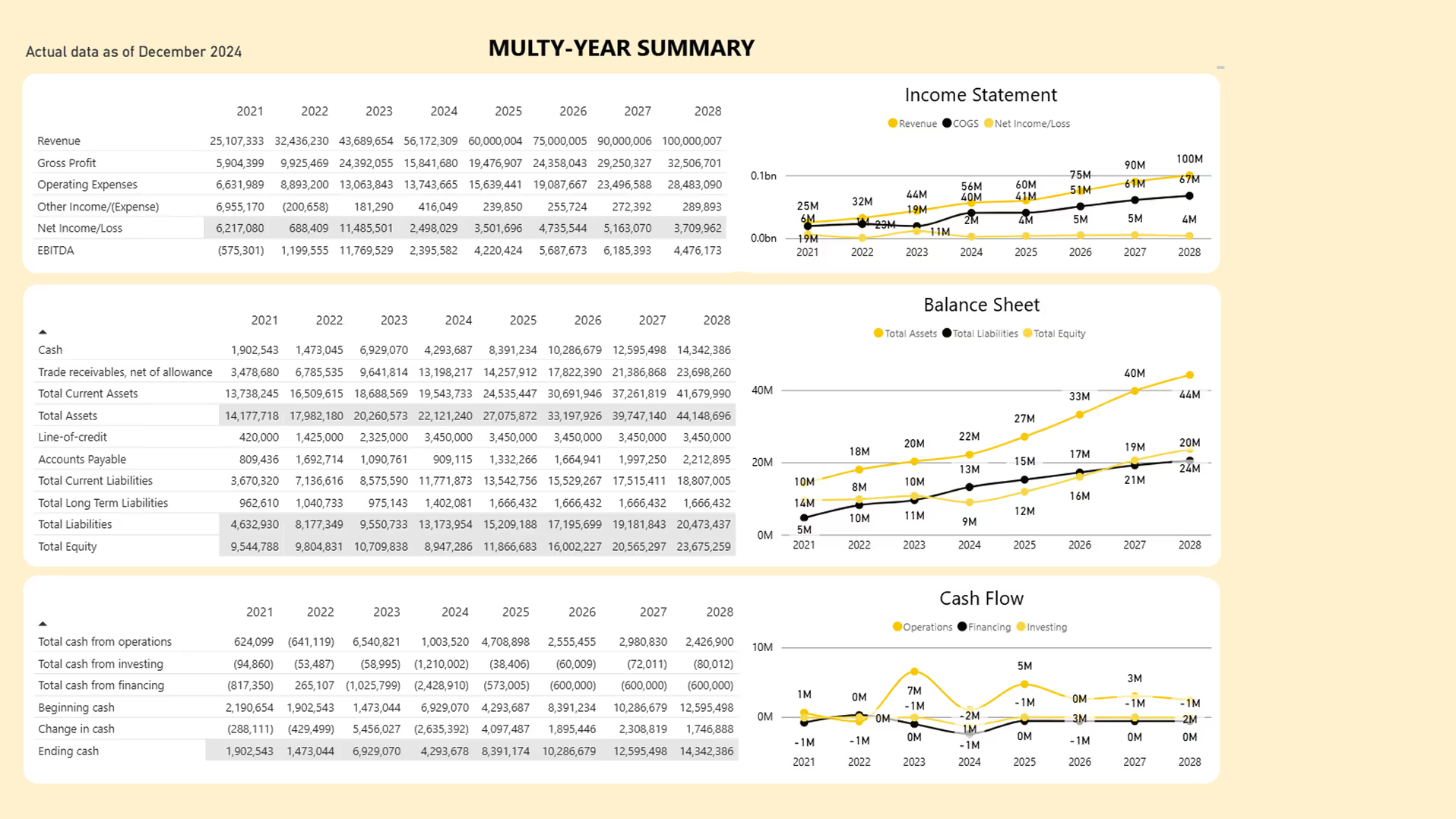

Not just an institutional-grade financial model. Not just 18 ready-to-use dashboards.

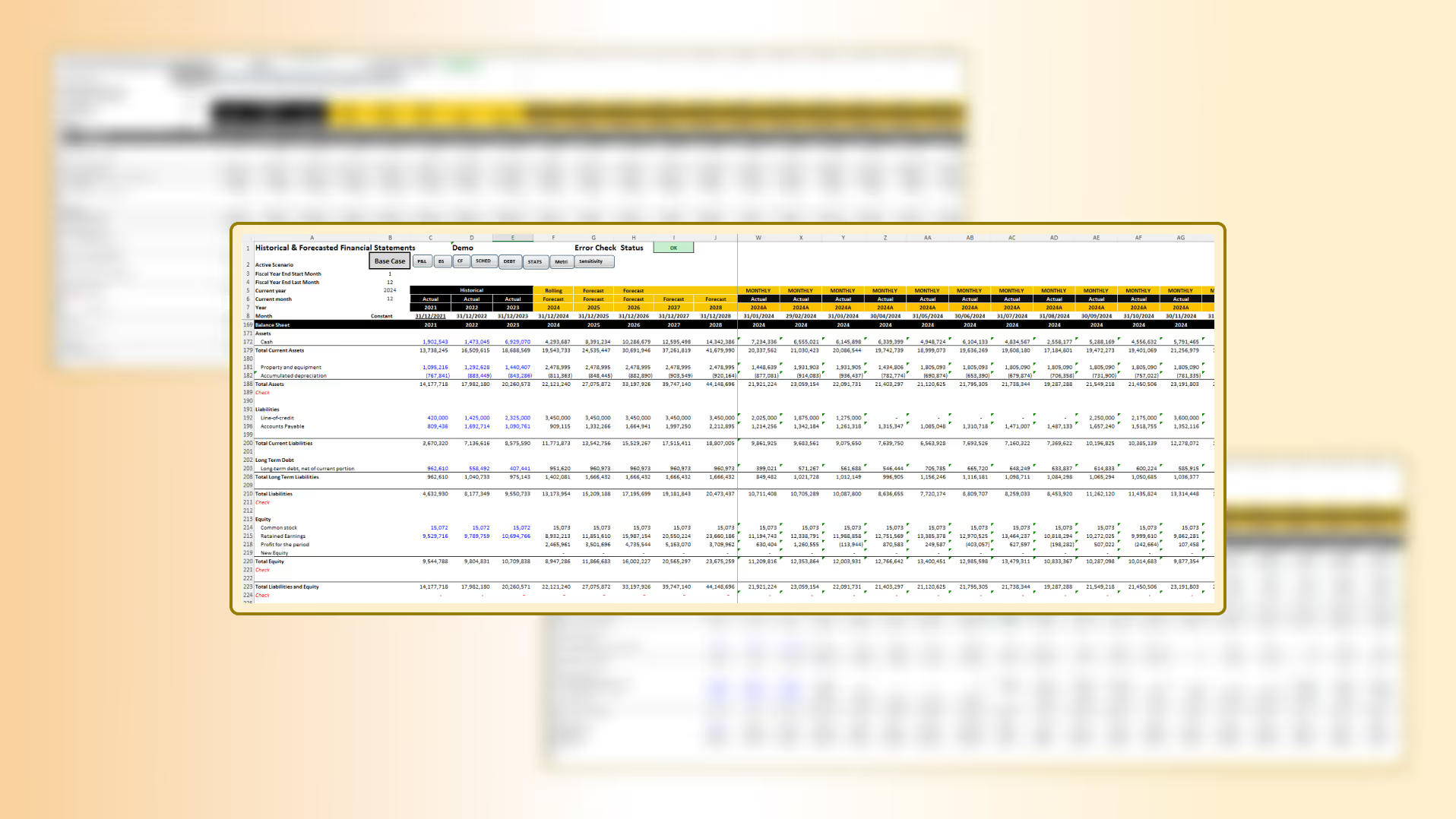

Financiario is a fully managed finance system that turns your raw data into audit-ready reports, rolling forecasts, and decision-ready insight your leadership can trust and act on.

It’s what you’d expect from a strategic CFO built right into your system.

From Raw Data to Strategic

Foresight in 7 Days

You give us secure read-only access to your financial records and key operational data.

We design your 3-statement, 10-year, 60-month rolling forecast model and custom dashboards around your business model.

Actuals flow in automatically each month; you have real-time visibility to analyze, decide, present, and negotiate from one source of truth.

What You Gain with Financiario

Long-range visibility, live forward plans, and driver-based control over performance and cash.

Feature rich. Insight ready.

Praised by CEOs, CFOs, and Finance Leaders Worldwide

Financiario has been transformative

"Working with this team has been transformative. The dashboard development and our monthly calls have boosted my confidence and expanded my creative thinking. I've gained invaluable financial insights and tools that have deepened our financial understanding. I highly recommend Financiario and the team."

Financiario Is incredible!

"We didn't have the right skills on our team to do better but we desperately needed better planning. Financiario took our vision and our data and built us the perfect system in just a few days. We have live dashboards to tell us everything we need to know about how we're doing and what to do next. We know the impact of every decision on our long-range plans. And we can meet anytime with anyone to discuss the business. It's incredible. "

Financiario Is incredible!

"The solution is phenomenal. The charts and metrics give us exactly what we’ve been looking for and are making a substantial difference in our business.I like being able to see the high-level view and then drill down into the details. Having month-by-month visibility—without waiting for quarterly reports—this will be a game changer for us."

Financiario is fantastic!

"Financiario is fantastic. The dashboards and forecasting capabilities are incredibly impressive."

Financiario is a no brainer!

"It's a no brainer to me, everything you built…it's absolutely fantastic! My PE firm will love to have all this"